Personal Reflections on Approaching Retirement Age

As I approach my 65th birthday this month, the US Social Security Administration has already sent me a letter detailing my retirement options. While I could choose to retire immediately and begin receiving my publicly provided pension, they encourage waiting another five years for significantly higher payments. Despite this financial incentive, I have no current plans to retire, health permitting.

My professional inspiration remains Amartya Sen, who continues his academic work at Harvard well into his 90s. The truth is, I find myself easily bored without structured work. During office hours, I can wander halls, chat with students or colleagues, or even join a spontaneous table-tennis game. These brief diversions refresh me for continued productivity.

The Homebound Reality and Retired Husband Syndrome

At home, however, the dynamic changes completely. During pandemic lockdowns, I discovered that when everyone else remains busy with their own tasks, I often create unnecessary work—cleaning already clean surfaces, organizing items that don't require organization, and generally becoming what my family might politely call "disruptive."

This phenomenon has been formally recognized in Japan as "Retired Husband Syndrome," where women experience genuine anxiety, depression, and even physical symptoms as their husbands approach retirement. The syndrome emerges from traditional Japanese family structures where salarymen spent minimal time at home during their working years, creating couples who essentially became strangers sharing living space.

While my wife is too gracious to express such concerns directly, I suspect she prefers my continued employment, especially since she enjoys working from home herself.

Family History and Deeper Anxieties

My personal apprehension about retirement stems partly from observing my grandfather's experience. When I first met him at age five, he was exactly my current age—65 and facing mandatory retirement from his distinguished career as an educator.

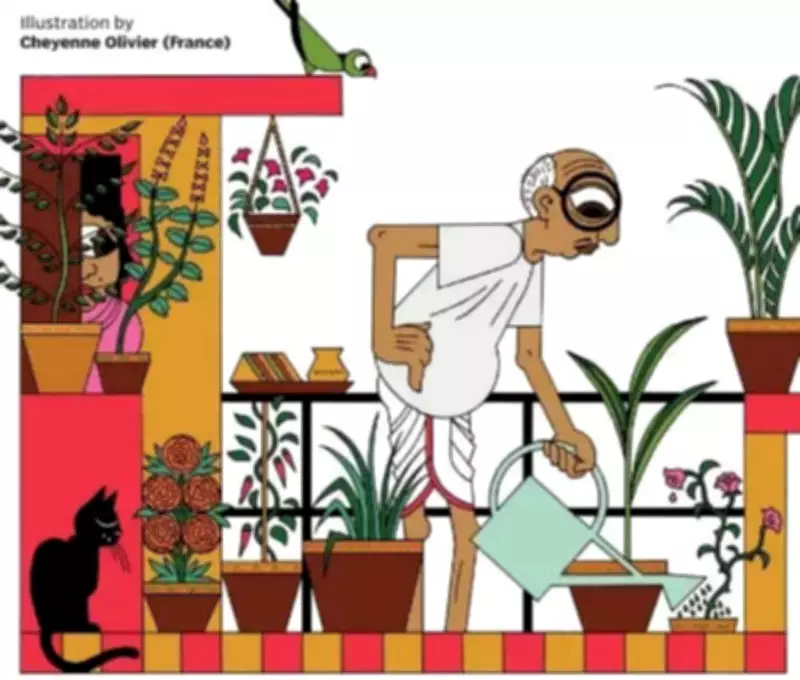

He attempted to fill his days with gardening, transforming our terrace with numerous clay pots and various plant cuttings. Yet despite this apparent activity, I often found him staring into the distance, his watering can dripping unused water, his snacks growing cold beside him. His existing bipolar condition worsened significantly after retirement, creating a lasting impression that fuels my own retirement fears.

The Global Pension Crisis: France as Case Study

Meanwhile, France experiences massive political upheaval over precisely the opposite concern—the right to retire earlier with adequate state support. President Emmanuel Macron's attempts to raise the retirement age from 62 to 64 have triggered such vigorous opposition that five governments have fallen during the process.

The French protests highlight a fundamental demographic reality facing all developed nations. When current retirement systems were established, life expectancy was significantly lower. In 1981, when many current French retirees entered the workforce, life expectancy stood at 74 years. Today it reaches 83 years, meaning people now spend 21 years in retirement rather than the originally planned 12.

The Demographic Perfect Storm

Three converging factors create what I call "the impossible trifecta" for rich nations:

- Aging populations with more pensioners living longer than ever before

- Shrinking working-age populations due to declining fertility rates

- Political resistance to both increased immigration and wealth taxation

Even countries like Denmark recognize this reality, gradually raising retirement ages to 70 or beyond. Others watch France's struggles, knowing similar conflicts await them.

The AI Solution Fallacy

Some suggest artificial intelligence might solve these demographic challenges through increased productivity. However, even if AI delivers promised efficiency gains, fundamental questions remain unanswered. Who benefits from these productivity increases? How would additional wealth be redistributed to support pension systems?

If AI eliminates numerous jobs while concentrating wealth among the ultra-rich—who consistently resist higher taxation—the pension funding crisis would actually worsen rather than improve.

Political Paralysis and Future Consequences

The current political equilibrium in France, the United States, and most developed nations demonstrates alarming paralysis. Governments recognize the pension funding crisis but lack political will for substantive solutions. The French government recently retreated from proposed billionaire taxes that could have addressed pension shortfalls, bowing to pressure from wealthy interests.

This delay strategy proves increasingly dangerous. Each year of inaction means more retirees claiming benefits the system cannot sustainably support, making eventual adjustments more drastic and politically difficult.

My personal retirement anxiety thus intersects with a much larger global challenge. While I'm fortunate to have work I love, millions face mandatory retirement from physically demanding jobs they can no longer perform. Yet the systemic crisis affects everyone—those who wish to work longer and those who cannot continue, those who fear retirement and those who eagerly anticipate it.

The solution requires honest demographic accounting, intergenerational solidarity, and political courage that currently remains in short supply across the developed world.