India's industrial sector displayed a remarkable surge in November, with output growth climbing to its highest level in over two years. The robust performance was primarily fueled by a significant rebound in manufacturing and mining activities, which managed to counterbalance a contraction in electricity generation.

Key Sectors Drive Record Growth

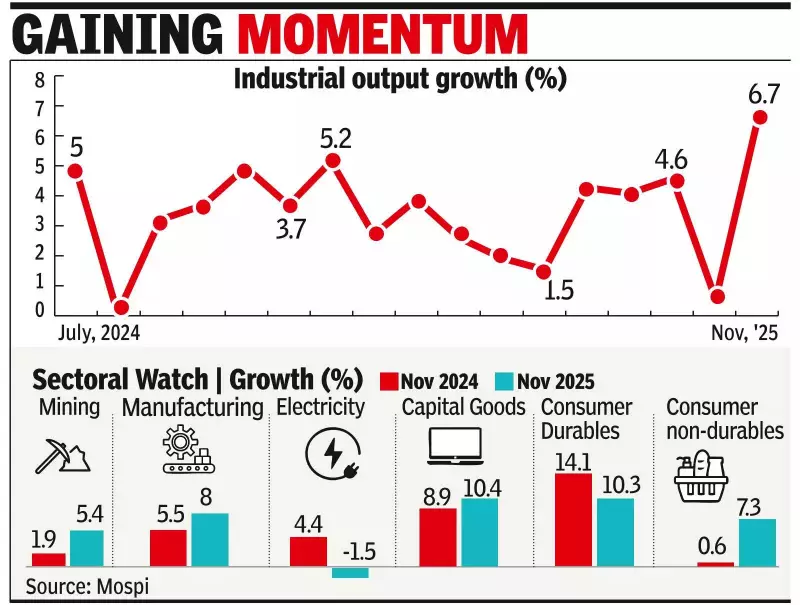

Data released by the National Statistical Office (NSO) on Monday revealed that the Index of Industrial Production (IIP) expanded by 6.7% annually in November 2025. This marks a substantial acceleration from the 0.5% growth recorded in October and is also higher than the 5% expansion seen in November of the previous year.

The manufacturing sector, a critical component of the IIP, was the standout performer. It registered an impressive growth of 8% in November, a sharp rise from the 2% in October and surpassing the 5.5% from November last year.

Similarly, the mining sector staged a strong recovery. After being hampered by unseasonal rains, it grew by 5.4% in November. This is a notable turnaround from the 1.8% contraction witnessed in October and is also better than the 1.9% growth a year ago.

Consumer and Investment Demand Show Strength

A highlight of the November data was the vigorous expansion in consumer-facing industries. The output of consumer durables soared by 10.3%, while non-durables grew by a healthy 7.3%. This reversal from previous months' contractions signals a potential revival in domestic consumption.

Commenting on this trend, Rajani Sinha, Chief Economist at CareEdge, stated, "On the demand front, the positive aspect was the improvement in the output of consumer durables and non-durables. Factors such as GST rationalisation, income tax relief, and easing inflation have boded well for the consumption scenario."

The investment landscape also appeared promising. The capital goods sector, a key indicator of investment activity, rose by 10.4% annually. This growth is significantly higher than the 2.1% recorded in October and exceeds the 8.9% expansion from November last year. Sinha added that there has been "sustained healthy momentum in the growth of infrastructure/construction goods and capital goods output."

Outlook and Potential Headwinds

While the November numbers are encouraging, economists point to possible challenges ahead. Aditi Nayar, Chief Economist at ICRA, noted that the impact of recent US tariffs and penalties is likely to be felt across some manufacturing segments. This could partly offset the positive effects of the recent GST rate revisions.

However, Nayar also highlighted a positive sign for the immediate future: "Electricity demand has expanded in December 2025 after a gap of two months, which should boost power generation in the month, auguring well for IIP growth." She expects IIP growth to moderate to a range of 3.5% to 5.0% in December as the base effect normalises and the benefits from inventory restocking diminish.

The November industrial production data paints a picture of a resilient economy with strengthening demand in both consumption and investment. The performance of core sectors will be crucial in sustaining this momentum in the coming months.