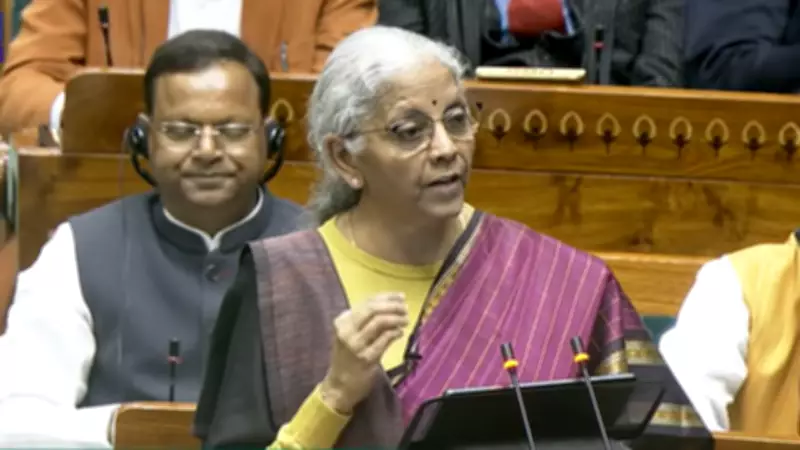

Finance Minister Nirmala Sitharaman Presents Union Budget 2026 with Major Taxpayer Reforms

Finance Minister Nirmala Sitharaman on Sunday presented the Union Budget for the fiscal year 2026, marking her ninth consecutive budget presentation. The budget unveiled significant changes aimed at simplifying the tax system and providing relief to taxpayers across various categories.

Key Tax Reforms and Simplified Compliance Measures

The budget introduces a comprehensive overhaul of tax administration with the primary objective of making compliance easier for ordinary citizens. The government has announced simpler rules, completely redesigned tax forms, and multiple relief measures designed to reduce the tax burden on individuals and service providers.

The new Income Tax Act, 2025 will come into effect from April 1 this year, bringing with it a streamlined approach to direct taxation. Finance Minister Sitharaman emphasized that these changes are specifically crafted to remove ambiguities that have traditionally affected taxpayers and service providers.

Major Announcements and Structural Changes

The budget includes several important structural modifications to the tax filing process:

- The timeline for filing revised income tax returns has been extended from December 31 to March 31, with only a nominal fee applicable for late submissions.

- Individual taxpayers filing ITR 1 and ITR 2 forms will continue to have a filing deadline of July 31, while non-audit business cases and trusts will now have an extended due date of August 31.

- Small taxpayers will benefit from a new provision allowing them to avail rule-based lower or nil tax deduction without needing to file formal applications for lower withholding certificates.

- The government has proposed to exempt any interest awarded by the Motor Accident Claims Tribunal to natural persons, providing additional financial relief.

Reduced TCS Rates for International Transactions

In a significant move to ease financial burdens on international transactions, the budget proposes substantial reductions in Tax Collected at Source (TCS) rates:

- The TCS rate on education and medical purposes under the Liberalised Remittance Scheme (LRS) has been reduced from 5% to 2%.

- The TCS rate on overseas tours and travel packages is proposed to drop from the previous rates of 5% or 20% down to a uniform 2%.

These reductions are expected to make international education, medical treatment, and travel more affordable for Indian citizens while maintaining necessary regulatory oversight.

Capital Expenditure Target and Broader Economic Context

Alongside the tax reforms, the government has set an ambitious capital expenditure target of Rs 12.2 lakh crore for the fiscal year 2027. This substantial investment in infrastructure and development projects is designed to stimulate economic growth and create employment opportunities across sectors.

The budget presentation comes amid expectations from salaried and middle-class taxpayers for additional relief measures in the new tax regime for the financial year 2026-27. While the budget addresses several compliance issues, market observers note that specific income tax slab revisions remain a point of anticipation for many taxpayers.

Finance Minister Sitharaman concluded her budget speech by emphasizing that these comprehensive changes represent the government's commitment to creating a more taxpayer-friendly system that reduces unnecessary burdens while maintaining fiscal responsibility.