Budget 2026-27 Proposes Major Hike in Investment Limits for Foreign Residents

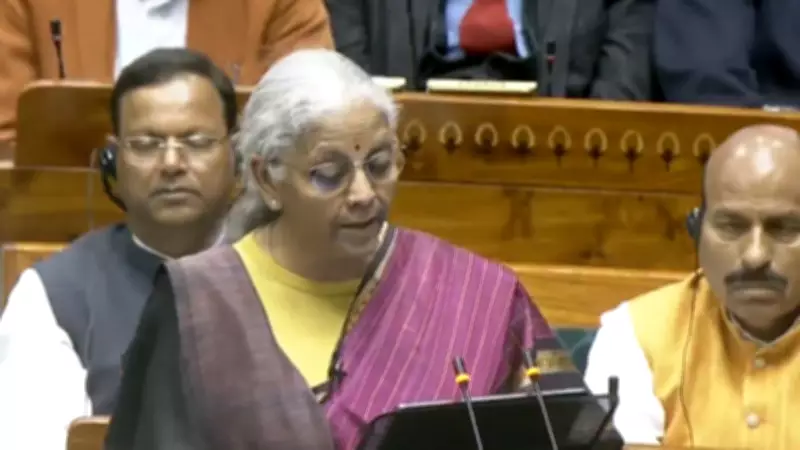

In a significant move to bolster foreign investment, the Union Budget for 2026-27 has announced a substantial increase in investment limits for Persons Resident Outside India (PROIs). Finance Minister Nirmala Sitharaman revealed that the overall investment cap for PROIs will be raised to 24% from the existing 10%, while the individual investment limit will be doubled to 10% from 5%.

Comprehensive Review of FEMA Regulations Planned

The budget also outlines plans for a comprehensive review of non-debt instruments rules under the Foreign Exchange Management Act (FEMA). This initiative aims to create a more contemporary and user-friendly framework for foreign investment, specifically designed to boost capital inflows and strengthen India's position as an attractive investment destination.

These measures come amid concerns over capital outflows and are strategically targeted at enhancing foreign investments. A PROI is defined as any individual or entity that does not meet India's residency criteria under FEMA regulations.

Expanding Investment Avenues Beyond NRIs and OCIs

The changes are expected to facilitate investments from non-Indian foreign nationals, extending beyond the traditional categories of Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs). Currently, foreign residents can invest through either Foreign Direct Investment (FDI) or Foreign Portfolio Investment (FPI) routes, subject to sectoral caps and regulatory limits.

Under the new provisions, PROIs will be permitted to invest in equity instruments of listed Indian companies through the Portfolio Investment Scheme. This move is anticipated to simplify the investment process and attract more diverse foreign capital.

Expert Reactions and Market Implications

Sanjay Kumar, Director at Nangia Global Advisors LLP, commented on the development, stating, "Ease of Doing Business is strengthened as persons resident outside India are permitted to invest in listed equities via the portfolio route. Doubling the individual cap to 10% and raising the aggregate limit to 24% will deepen markets and also boost FDI inflows."

Amit Maheshwari, Managing Partner at AKM Global, highlighted the practical benefits, noting that the existing Portfolio Investment Scheme requires non-resident individuals to use dedicated NRE PIS demat accounts with specific reporting requirements. He explained that the budget announcement "eliminates FPI registration hurdles for direct retail access, cuts compliance costs and time, boosts market liquidity and depth, reduces classification disputes for companies, and channels more diverse foreign inflows without diluting control safeguards."

Context from Economic Survey 2025-26

The Economic Survey 2025-26, presented just before the budget, had flagged concerns about global capital strikes and their adverse impact on the rupee's stability. Despite India's strong macroeconomic fundamentals, the survey noted that the rupee was "punching below its weight" with valuations not accurately reflecting economic strengths, causing investor hesitation.

The survey also pointed out that FDI inflows remain below potential, especially for infrastructure needs, and suggested learning from other countries' approaches including:

- Tax holidays and customs exemptions

- Investment missions and tailor-made tax incentives

- Low-interest loans and visa concessions

- R&D tax incentives and streamlined project approvals

It recommended creating a task force to engage top global companies and promote India's advantages in stability, macroeconomic strength, sustained growth, and market size to boost FDI in targeted sectors.

Addressing Capital Flight Concerns

The Economic Survey had specifically warned about capital flight risks, including those associated with the advent of US stablecoins. While an undervalued rupee can help offset the impact of higher US tariffs, the survey emphasized that investor reluctance to commit to India warrants careful examination.

The budget measures appear designed to address these concerns by creating a more welcoming environment for foreign investment through simplified regulations and increased investment limits.