The Patna zonal unit of the Enforcement Directorate (ED) has taken decisive action in a major banking fraud case, carrying out search operations at four locations in Muzaffarpur. The raids are part of an investigation into the fraudulent siphoning of funds from accounts held at a local branch of the Punjab National Bank (PNB).

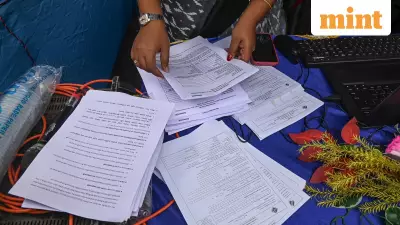

Seizure of Incriminating Evidence and Account Freezing

During the recent searches, officials seized a trove of incriminating documents and materials related to the case. In a significant move, the federal agency also froze funds amounting to ₹83 lakh that were lying in the bank accounts of the alleged perpetrators. The ED made this announcement on Tuesday, highlighting the progress in the probe.

The Sophisticated Modus Operandi of the Fraud

According to the ED, the investigation was launched based on two First Information Reports (FIRs) registered by the Bihar Police at the Town Police Station in Muzaffarpur. The FIRs were filed under relevant sections of the Indian Penal Code, which are classified as scheduled offences under the Prevention of Money Laundering Act (PMLA), 2002.

Probe findings revealed an elaborate scheme of banking fraud and money laundering that led to the illegal withdrawal of ₹1.29 crore from the savings accounts of two victims. The amounts stolen were ₹1.07 crore and ₹22.40 lakh respectively. These accounts were maintained at the PNB branch located on Jawaharlal Road in Muzaffarpur.

The criminals executed the fraud using a highly sophisticated method. The scam centered on SIM card swapping and the manipulation of online banking services. The fraudsters first illicitly swapped the mobile phone numbers of the victims, which were registered with the bank for receiving SMS alerts and for two-factor authentication for online banking. They accomplished this by using forged identity documents.

Money Trail and Further Investigation

With control over the duplicate SIM cards, the accused then activated internet banking on the victims' accounts by contacting PNB's toll-free customer service number. Once they gained digital access, they transferred large sums out of the accounts.

The stolen money was then routed through multiple layers in a classic money laundering technique. A substantial portion of the funds was withdrawn in cash from Automated Teller Machines (ATMs) located in Kolkata. This cash was subsequently deposited into various bank accounts belonging to the perpetrators using cash deposit machines, further obscuring the trail.

The Enforcement Directorate has stated that further investigation in the case is currently underway to identify all individuals involved and to trace the complete trail of the defrauded money.