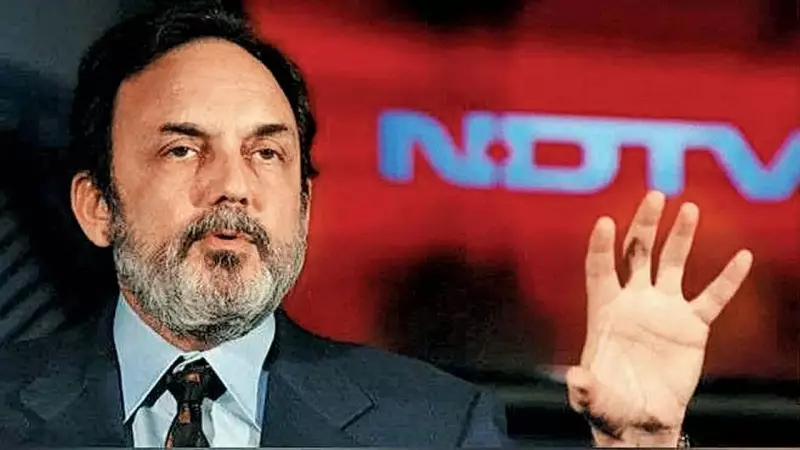

Delhi High Court Cancels 2016 Tax Notices Against NDTV Founders

The Delhi High Court delivered a significant verdict on Monday. It quashed the 2016 income-tax reassessment notices issued to NDTV founders Prannoy Roy and Radhika Roy. The court also directed the tax department to pay costs of Rs 1 lakh to each founder. This decision came as a strong rebuke for what the bench termed harassment through arbitrary proceedings.

Court Slams Arbitrary Actions by Tax Authorities

A bench comprising Justices Dinesh Mehta and Vinod Kumar made sharp observations. They noted that authorities subjected the Roys to reassessment proceedings for a second time. This action concerned practically the same issue as before. The bench declared this approach arbitrary and without proper jurisdiction.

The court stated clearly that initiating reassessment in such circumstances leads to unnecessary harassment of taxpayers. It also creates unpredictability and uncertainty in the system. The judges emphasized that the facts of this case reveal how proceedings can become arbitrary. They further highlighted violations of statutory provisions and fundamental principles of adjudication.

Token Costs Imposed as Deterrent

While allowing the petitions filed by the couple, the High Court imposed costs. The bench acknowledged that no amount of cost could truly compensate for such harassment. However, they decided not to leave the matter without imposing any penalty. Consequently, they ordered a token cost of Rs 1 lakh per case. The respondents must pay this amount to each petitioner.

The court also raised concerns about procedural inconsistencies. They flagged how a change in officer resulted in changed proceedings. The bench stressed an important principle. Merely because new officers feel wiser or hold different opinions does not justify unsettling already settled assessments. Taxpayers should not face the rigmarole of assessment proceedings repeatedly.

Background of the Tax Notice

The income-tax notice in question focused on reassessment of the petitioners' income for the financial year 2009-10. This reassessment centered around certain interest-free loans received by the Roys. These loans came from RRPR Holding Private Limited, the promoter entity of NDTV. At that time, both Prannoy Roy and Radhika Roy served as shareholders and directors of RRPR.

The Delhi High Court's ruling brings closure to this prolonged legal battle. It reinforces protections against arbitrary tax reassessments. The decision underscores the importance of procedural fairness in tax administration. Legal experts view this as a significant precedent for similar cases involving repeated tax notices.