Despite facing a barrage of tariffs and trade restrictions from the United States, China's global trade machine is not just surviving but thriving, with exports to the rest of the world surging to fill the gap left by America. New data reveals a significant geographical shift in China's trade flows, with nations in the Global South and Europe becoming increasingly vital partners.

The American Onslaught and Chinese Retaliation

Since Donald Trump's return to the White House, China has been the primary target of his trade policy. The former president has labeled China the "chief-ripper-offer" and "deepest, darkest China," backing his words with substantial action. The US has imposed some of its highest tariffs on Chinese goods, citing issues like the fentanyl trade. It has also forged pacts with Southeast Asian nations to counter suspected transshipment of Chinese goods and pressured the European Union to exclude Chinese metals from supply chains.

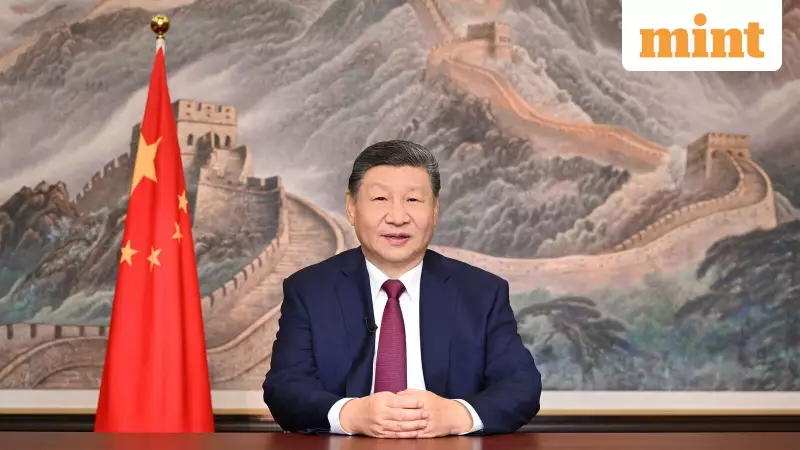

In response, Chinese President Xi Jinping has implemented retaliatory tariffs and actively courted other major economies. At the Shanghai Co-operation Organisation summit on September 1st, President Xi positioned China as a global alternative to the US, urging members to reject "cold war thinking" and "bullying." His diplomatic outreach has extended to the EU, India, Malaysia, and Vietnam.

Trade Data Tells a Story of Resilience and Redirection

The practical impact of this geopolitical tussle is now clear from the latest trade figures. Chinese customs data released on September 8th shows a stark decline in trade with the US. Over the past three months, China's exports to America plummeted by 25% year-on-year. America's share of China's total exports halved, falling from 15% to just 10% in August alone.

However, President Trump's broader goal of crippling China's trade has failed. From June to August 2025, China's total global shipments grew by a robust 6% compared to the same period last year. This growth was powered by massive increases in exports to other regions:

- Exports to Africa surged by a third.

- Shipments to the Association of South-East Asian Nations (ASEAN) climbed by a fifth.

- Sales to Europe increased by nearly 10%.

Europe now imports over 60% more Chinese goods than the US, a dramatic reversal from a year ago when both markets held similar shares.

The Belt and Road Engine Fuels Global South Growth

This redirection is no accident. It is underpinned by China's decade-old Belt and Road Initiative (BRI), which has laid firm foundations across the developing world. Since President Trump's return, BRI activity has accelerated sharply. Research from the Griffith Asia Institute indicates that in the first half of 2025, BRI contracts and investments hit a record, exceeding $120 billion.

Nearly half of the construction contracts under the initiative, all awarded to Chinese firms, are for projects in Africa, totaling over $30 billion—a fivefold increase from the previous year. This infrastructure drive is directly fueling trade. For instance, Chinese exports to Nigeria jumped by over 50% in the last three months, driven largely by demand for equipment to build Chinese-financed railways and power plants.

Beyond trade, Chinese financial influence is growing. Kenya plans to convert dollar-denominated Chinese loans into yuan, while Egypt, Nigeria, and South Africa have signed currency swap agreements with China.

Supply Chain Reconfigurations and the North American Exception

China is also deepening its integration into Asian supply chains. Between June and August, exports to Thailand and Vietnam were 25% higher than a year earlier, with electronics and machinery flows soaring by over 40%. While some of this may be "front-loading" ahead of potential tariffs, a more structural shift is underway. Chinese firms are moving production into ASEAN nations like Indonesia, Malaysia, and Vietnam to meet local rules-of-origin, thereby cementing their role in regional trade networks.

The notable exception to this global expansion is in North America's backyard. From May to July, Mexican imports from China fell by 6%. This decline may steepen after Mexican President Claudia Sheinbaum announced new tariffs on September 4th targeting Chinese cars, textiles, and plastics—a move designed to protect local industry and appease the US vision of a "Fortress North America."

Historians might draw a parallel to the Ming dynasty's inward turn and the construction of the Great Wall, a retreat that arguably sapped China's vitality. The current trade data suggests that by building its own economic walls, America risks a similar strategic miscalculation, while China successfully cultivates new partnerships across Asia, Africa, and Europe.