Noida's Wish Town Homebuyers Confront Fresh Legal Turmoil

Noida's Wish Town housing project plunges into another crisis. Delhi Police's economic offences wing files a serious FIR against Suraksha Realty and Lakshdeep Investments. The complaint comes from the Enforcement Directorate. It alleges diversion of funds meant for completing flats across Jaypee Infratech Ltd projects.

Thousands of Homebuyers Remain in Limbo

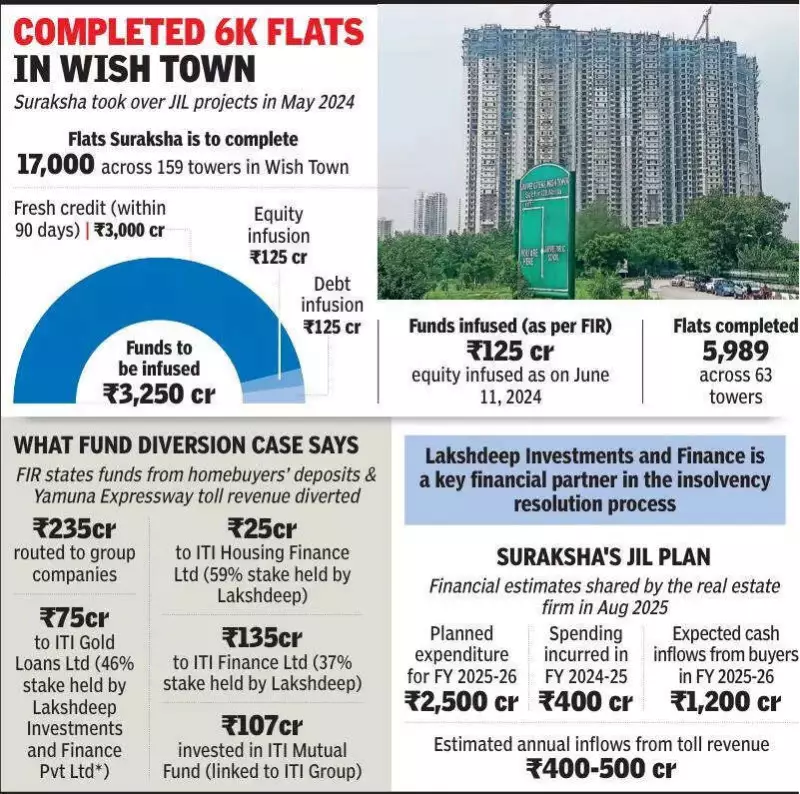

Wish Town in Sector 120 stands as the largest affected project. Suraksha Realty holds responsibility for completing 17,000 flats here. Many buyers received promises over a decade ago. Suraksha took control of Jaypee Infratech in 2024 after a lengthy insolvency process.

Police registered the FIR on January 1. They invoked sections 406 for criminal breach of trust, 420 for cheating, and 120B for criminal conspiracy under the Indian Penal Code. The Enforcement Directorate investigates Jaypee Infratech under the Prevention of Money Laundering Act. They arrested former promoter Manoj Gaur in November 2025.

Alleged Fund Diversion Details Emerge

According to the FIR, Jaypee Infratech's CFO Rahul Gohil gave a statement to ED on May 23, 2025. He revealed that Rs 125 crore entered JIL as equity on June 11, 2024. This happened after Suraksha formally took over. However, other obligations like a Rs 3,000 crore credit facility did not materialize within the mandatory 90-day period.

Instead, funds allegedly flowed to entities connected to Lakshdeep and Suraksha. The FIR highlights multiple suspicious transactions. These include Rs 75 crore to ITI Gold Loans where Lakshdeep holds 46% stake, categorized as a loan. Another Rs 25 crore went to ITI Housing Finance with Lakshdeep's 59% stake. A substantial Rs 135 crore reached ITI Finance for vehicle loan financing, where Lakshdeep maintains 37% ownership.

Homebuyers' Money and Toll Revenue Misused

ED investigation suggests these transactions used funds from fixed deposits maintained by Jaypee Infratech. These deposits allegedly contained homebuyers' money and revenue from Yamuna Expressway toll collection. Jaypee served as concessionaire for this expressway.

The agency also discovered JIL invested Rs 107 crore in ITI Mutual Fund. This fund belongs to the Lakshdeep-linked ITI group. Investment Trust of India Ltd acts as the main holding company for ITI group. Chintan Vijay Valia, son-in-law of Suraksha Group promoter Sudhir Valia, serves as a director here.

ED claims this investment came from proceeds of Jaypee Healthcare's sale to Max Healthcare in 2024. From these sale proceeds, besides the mutual fund investment, Rs 397 crore went into State Bank of India fixed deposits. Another Rs 105 crore purchased a plot from ICICI Bank through a surrender deed dated March 19, 2025.

Central Agency Sees Clear Diversion Pattern

The Enforcement Directorate views these transactions as prima facie evidence of fund diversion. These funds should have completed stalled apartments. The agency notes homebuyers approached National Company Law Tribunal earlier. They sought a monitoring committee to oversee resolution plan implementation. Construction has not progressed at promised speeds a year after takeover.

Suraksha Realty did not respond to media queries about the FIR charges. Interestingly, the company claimed earlier this week it completed construction of 5,989 flats across 63 residential towers since taking over JIL.

Wish Town's Troubled History

Wish Town comprises 10 residential projects with 159 towers total. Launched in 2010-11, these projects originally promised delivery in 2014-15. Years of litigation, debt, and insolvency halted construction. Approximately 20,000 homebuyers across JIL projects face endless delays.

IDBI Bank initiated insolvency proceedings against JIL in August 2017. Suraksha edged out state-run NBCC in committee of creditors voting. NCLT approved its resolution plan on March 7, 2023. NCLAT upheld this decision in May 2024. The plan aimed to revive JIL by settling debts, completing stalled projects, and ensuring fair treatment for all stakeholders.

Resolution Plan Promises and Shortcomings

For homebuyers with admitted claims of Rs 12,806 crore, the plan promised completion of all pending flats within four years. Financial creditors held admitted claims of Rs 9,783 crore. The plan addressed these through land parcels exceeding 2,500 acres and nearly Rs 1,300 crore in non-convertible debentures. Operational creditors, including Yamuna Expressway Industrial Development Authority, saw their claims significantly reduced.

Critically, the plan required Suraksha Group to generate fresh construction funds. This included infusion of Rs 125 crore as equity, Rs 125 crore as debt, and arrangement of a fresh Rs 3,000 crore credit facility within 90 days of approval.

Homebuyers Express Relief and Concern

Ashish Mohan Gupta, president of JIL Real Estate Allottees Welfare Society, shared his perspective. "The stand taken by us on diversion of funds by Suraksha is vindicated by ED's findings and the FIR," he stated. "We urge the authorities to act expeditiously to ensure recovery of homebuyers' money and its rightful utilisation for the construction of their homes."

Longstanding Investigation Background

ED's PMLA investigation originates from multiple complaints by homebuyers and investors. They alleged fraud in Jaypee housing projects like Wish Town and Jaypee Greens. These complaints led to FIRs by Delhi Police's economic offences wing in 2017 and 2018. UP Police also registered cases against JIL, its parent company Jaiprakash Associates Ltd, and their promoters.

The situation remains fluid as authorities continue their investigation. Thousands of homebuyers await resolution while legal proceedings unfold.