India's Small Commercial Vehicle Segment Stages Strong Comeback

India's small commercial vehicle segment has made a powerful recovery. This vital part of the economy supports last-mile transportation across the country. After facing nearly two years of slowdown, volumes are now rising sharply.

Understanding the SCV Segment

The small commercial vehicle segment includes two main types of vehicles. Pick-ups have a gross vehicle weight between 2 and 3.5 tonnes. Mini-trucks weigh up to 2 tonnes. Together, these vehicles dominate the light commercial vehicle market with an 85 percent share.

Impressive Growth Figures

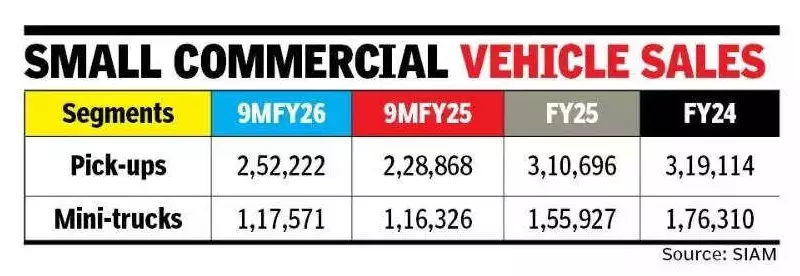

For the first nine months of the current financial year, the SCV segment reported strong growth. Total volumes reached 369,793 units. This represents a 7 percent increase compared to the same period last year, which saw 345,194 units.

The mini-truck segment showed modest growth. It moved from 116,326 units to 117,571 units. Meanwhile, the pick-up segment performed exceptionally well. It recorded a 10 percent rise, climbing from 228,868 units to 252,222 units.

Key Drivers of Recovery

Poonam Upadhyay, Director at Crisil Ratings, explained the factors behind this resurgence. The third quarter witnessed significant growth momentum, she noted. Festive and rural demand played a crucial role. Increased construction and infrastructure activity also contributed substantially.

Improving last-mile logistics further supported the recovery. Upadhyay highlighted two important policy changes. The recent GST reduction on commercial vehicles from 28 percent to 18 percent has boosted purchase sentiment. Lower interest rates have made financing more attractive, especially for higher-payload pick-ups.

Market Leadership and Shifts

Mahindra dominates the pick-up segment with a commanding 60 percent market share. Ashok Leyland follows with 20 percent. Tata Motors holds third position with 18 percent.

In the mini-truck segment, Tata Motors maintains leadership with 52 percent share. The company revolutionized this market back in 2005 with the launch of the Ace, India's first low-tonnage goods vehicle. Maruti Suzuki captures second place with 24 percent through its Super Carry model. Mahindra ranks third with 23 percent share.

Structural Changes and Future Trends

The SCV segment has undergone important structural changes over recent years. In the 2019 financial year, total sales reached 5.15 lakh units. Mini-trucks accounted for 2.35 lakh units while pick-ups contributed 2.80 lakh units.

A clear shift has occurred toward pick-ups offering payload capacities exceeding one tonne. This movement away from sub-one-tonne mini-trucks reflects changing market preferences and operational needs.

Electrification Gains Momentum

Electric vehicles are making significant inroads into the SCV segment. New players have entered the market with electric offerings. Established manufacturers have also launched electric small trucks, signaling growing commitment to sustainable transportation solutions.

The recovery of India's small commercial vehicle segment demonstrates resilience in a crucial economic sector. With supportive policies and evolving market dynamics, this backbone of last-mile transportation appears poised for continued growth.