India's leading electronics manufacturing companies are set to embark on a strategic shopping spree in 2026. After a year of stock market turbulence and wafer-thin profits, the sector's top players are pivoting from low-margin assembly work to acquiring firms that specialize in high-value components.

The Margin Squeeze Driving Strategic Shifts

This aggressive acquisition strategy is a direct response to a severe profitability crunch. India's top five electronics manufacturers—Tata Electronics, Dixon Technologies, Amber Enterprises, Kaynes Technology, and Syrma SGS—collectively generated a massive ₹1.22 trillion ($13.6 billion) in operating revenue. Despite this impressive top-line figure, their bottom line told a different story.

In FY25, these five firms posted a cumulative consolidated net profit of just ₹1,599 crore ($179 million). This translates to a net profit margin of a mere 1.3%. Analysts note this slim margin exists even after the companies benefited from various government incentives, including Production-Linked Incentive (PLI) schemes for smartphones, IT hardware, semiconductors, and component manufacturing.

The poor profitability has severely impacted investor sentiment. Since January 1, 2025, shares of Dixon Technologies fell 26%, Amber Enterprises dropped 13%, and Kaynes Technology plunged 45%. Only Syrma SGS bucked the trend, with its share price rising 18% in calendar year 2025, while the benchmark BSE Sensex index grew by 8%.

Acquisitions Over Internal R&D: The Preferred Path

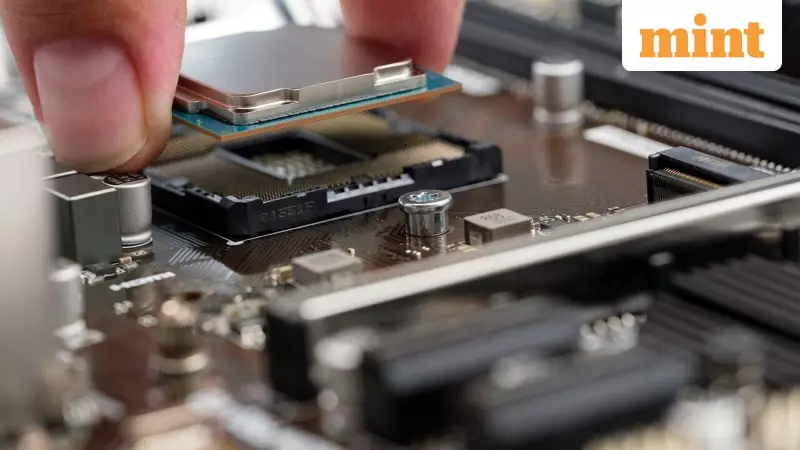

Faced with this pressure, companies view buying niche expertise as a faster, less risky route to higher margins than building capabilities in-house. Since April 1, these five firms have already announced a total of 17 acquisitions, targeting specialized areas like laptop component design, smart meter manufacturing, printed circuit boards (PCBs), inverters, and defence-grade electronics.

Industry executives confirm this focus. Jasbir Singh Gujral, Managing Director of Syrma SGS, stated the company is actively evaluating acquisition proposals to add core capabilities it currently lacks. He emphasized that expanding capabilities is central to improving profitability in today's electronics business.

Saurabh Gupta, Director of Finance and Group CFO at Dixon Technologies, outlined a clear acquisition roadmap. "We're open to strategic acquisitions in sectors that we're not present in," Gupta said. He identified PCB assembly, automotive electronics, industrial electronics, and aerospace and defence electronics as key verticals, driven by India's push for local sourcing.

Analysts support this strategy. Harshit Kapadia, Vice-President at Elara Capital, explained that the alternative—investing heavily in internal R&D, talent, and facilities—is far riskier and more capital-intensive. Acquisitions provide immediate access to market-proven technologies that can be integrated into existing product lines.

2026: A Pivotal Year for Value Addition and Confidence

Analysts believe 2026 will be a critical year for the sector to regain shareholder confidence. A major catalyst is expected to be the operationalization of India's first semiconductor packaging and testing plants. Ankush Wadhera, Managing Director and Partner at BCG India, noted that as these facilities come online, Electronics Manufacturing Services (EMS) companies will have a significant opportunity to upgrade their offerings.

"To realize domestic value from these plants, localizing core sub-components like circuitry, resistors, shells, coils, and wiring will offer significant margin and profit generation opportunities," Wadhera said. This local value addition is seen as essential for manufacturers to grow in both size and profitability.

While the acquisition trend is clear, approaches vary. Kaynes Technology, for instance, plans to first scale up its existing strengths and capacities. Jairam Sampath, Whole-time Director and CFO at Kaynes, said the company would consider acquisitions only if an opportunity promises strong long-term growth and profitability.

The collective move signals a maturation of India's electronics manufacturing sector. By moving up the value chain from simple assembly to designing and producing high-margin components like sensors, displays, and specialized circuits, these companies aim to build more sustainable and profitable businesses for the future.