Union Budget 2026: Demystifying the Finance Bill

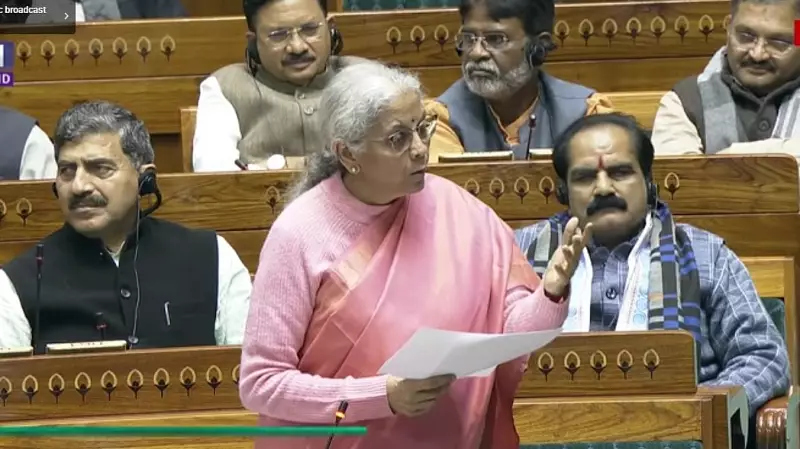

As Finance Minister Nirmala Sitharaman presents the Union Budget 2026, many citizens have questions about key terms. One common query revolves around the Finance Bill. What exactly is this document, and why does it matter for India's economic landscape?

The Core Function of the Finance Bill

The Finance Bill serves as the primary legislative instrument for implementing the budget's tax proposals. It contains all the amendments to various financial laws proposed in the budget speech. Instead of introducing separate bills for each change, the government bundles them into this single comprehensive document.

This approach streamlines the parliamentary process significantly. Lawmakers can review and debate all financial modifications in one place rather than navigating multiple pieces of legislation. The bill covers everything from income tax revisions to customs duty adjustments and GST modifications.

How the Finance Bill Simplifies Lawmaking

The bill achieves efficiency through consolidation. Imagine needing to amend ten different tax acts. Without the Finance Bill, parliament would need to pass ten separate amendments. This would consume substantial time and parliamentary resources.

The Finance Bill changes this dynamic completely. It incorporates all proposed adjustments into relevant existing laws through one legislative vehicle. This method has several practical advantages:

- Reduced legislative burden on Parliament

- Faster implementation of budget proposals

- Clearer understanding of how different tax changes interact

- Simplified tracking of amendments across multiple acts

Once Parliament passes the Finance Bill, it becomes the Finance Act. This enactment gives legal force to all the budget's taxation proposals. The changes take effect from the date specified in the act, typically the start of the financial year.

Why This Matters for Union Budget 2026

Understanding the Finance Bill helps citizens comprehend how budget announcements translate into actual law. When Minister Sitharaman proposes tax changes during her budget speech, those proposals need legislative approval to become enforceable. The Finance Bill provides that approval mechanism.

The bill also undergoes scrutiny and potential amendments during parliamentary discussions. Opposition parties can propose changes, and the government might modify provisions based on feedback. This democratic process ensures thorough examination of all financial proposals before they become law.

As India navigates economic challenges and opportunities in 2026, the Finance Bill will play a crucial role in implementing the government's fiscal vision. Its comprehensive nature makes it easier for businesses, taxpayers, and economists to understand the complete picture of tax changes proposed in the budget.