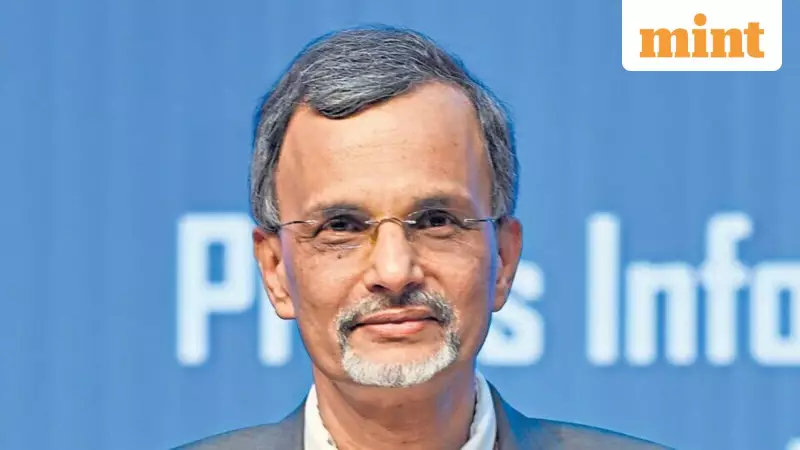

New Delhi witnessed a crucial discussion on financial inclusion as India's Chief Economic Advisor V. Anantha Nageswaran addressed the global inclusive finance summit on Tuesday. He presented a compelling vision where economic growth serves as the most sustainable driver of financial inclusion.

Beyond Mere Access: The Journey to Economic Independence

Nageswaran argued forcefully that true financial inclusion extends far beyond simple access to banking services. "We often measure success by counting bank accounts, loans disbursed, or mobile wallets activated," he noted. "But genuine inclusion represents a journey, not a statistical estimation."

The fundamental question, according to Nageswaran, shifts from whether people have entered the financial system to whether finance actually helps them achieve economic independence. He emphasized that inclusive finance must facilitate upward mobility rather than merely providing credit access.

Raising Incomes and Expanding Opportunities

The Chief Economic Advisor stressed that inclusive finance should accomplish three critical objectives:

- Raise household incomes substantially

- Expand economic opportunities meaningfully

- Reduce financial vulnerability effectively

"The ultimate goal must be purpose, not just participation," Nageswaran declared. He illustrated this principle with the PM SVANidhi scheme for street vendors, which helped restore liquidity after the COVID-19 pandemic.

Official data reveals that loans totaling ₹16,115 crore have been issued under this scheme. The poorest vendors used this credit to invest in basic assets, transitioning from survival trading to more productive operations and escaping low-return activities.

The PM SVANidhi Success Story

Nageswaran highlighted how the scheme enabled vendors not just to recover but to expand, invest, and strengthen their livelihoods. "This demonstrates how inclusive finance can help people invest, grow, and escape low-productivity equilibrium," he explained, "rather than merely smoothing consumption."

The scheme creates a vital bridge between the formal and informal sectors by generating transaction records for millions previously invisible to the banking system. "That bridge must be used," Nageswaran urged.

Responsible Lending and Investor Expectations

Nageswaran issued a strong warning about irresponsible lending practices. He pointed out that financial inclusion leading to indiscriminate lending destroys its very purpose, resulting in stress and over-indebtedness rather than empowerment.

He called on investors in inclusive finance institutions to accept lower financial returns in exchange for social impact. "True impact investing means explicitly pricing in social returns," Nageswaran stated. "That is not a weakness, that is the very definition of responsibility in this sector."

Banks Must Embrace New Borrowers

The Chief Economic Advisor urged mainstream banks to actively absorb proven borrowers like PM SVANidhi beneficiaries into their core portfolios. He emphasized that these individuals should receive regular loans, insurance products, and working capital lines—not just remain as scheme beneficiaries.

"Inclusive finance institutions are not ordinary commercial lenders," Nageswaran explained. "They serve as intermediaries between capital markets and some of the most economically vulnerable yet entrepreneurial people in society. This creates both moral and economic obligations."

Government Priorities and Global Context

Nageswaran's emphasis on ensuring financial inclusion enables productive growth and independence aligns with government priorities. Improving 'last mile' access and quality inclusion through digital infrastructure remains a key focus, highlighted during India's G20 presidency in 2022-23.

His suggestions carry particular significance as India continues to develop its financial inclusion framework, balancing economic growth with social responsibility in lending practices.